The shadow of overextended personal debt casts a long and damaging pall over an individual’s financial identity, primarily embodied by their credit ...

Read More

The relationship between overextended personal debt and credit score damage is a profound and destructive feedback loop, each fueling the other in a c...

Read More

The journey out of the daunting wilderness of overextended personal debt begins not with a single payment, but with a crucial act of understanding: ob...

Read More

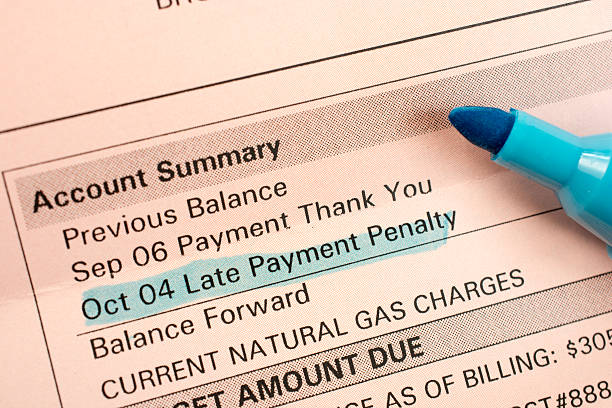

The diligent maintenance of on-time payments while carrying overextended personal debt represents a fragile state of financial limbo, a high-wire act ...

Read More

The journey to repair a credit report while actively repaying debt can feel like navigating a labyrinth. It requires a dual focus: methodically addres...

Read More

In the modern financial landscape, where identity theft is pervasive and data breaches are commonplace, adopting a proactive stance is no longer a lux...

Read MoreNon-profit credit counseling agencies provide education, budgeting assistance, and can administer Debt Management Plans (DMPs). They negotiate with creditors on your behalf to lower interest rates and waive fees, creating a structured path out of debt.

The most effective method is to pay down your existing balances. Even a small payment can make a noticeable difference in the percentage. Alternatively, you can request a credit limit increase from your card issuers, which lowers the ratio without requiring a payment, but this requires discipline to not spend the newly available credit.

Long auto loan terms (72-84 months) often lead to negative equity, meaning the borrower owes more than the car is worth. This traps them in the loan and can lead to rolling over old debt into a new loan, perpetually increasing their debt load.

BNPL leverages partitioning—breaking a large cost into smaller, seemingly insignificant parts. Four payments of $50 feels less impactful than $200 today, effectively masking the true cost and encouraging impulse purchases we might otherwise avoid.

While scores above 670 are considered "good," focus on steady improvement. Moving from a "Poor" score (below 580) to a "Fair" score (580-669) is a significant first milestone that opens up more options.