The intertwining of overextended personal debt and divorce creates a devastating feedback loop, where financial strain exacerbates marital discord and...

Read More

The dissolution of a marriage is one of life’s most profound emotional and logistical challenges. Beyond the heartache, it represents the fracturing...

Read More

The decision of whether to keep the marital home during a divorce is one of the most emotionally charged and financially significant choices a person ...

Read More

The financial obligations of child support and alimony represent a fundamental restructuring of an individual’s economic landscape. While their prim...

Read More

Reaching out to a creditor when facing financial hardship is a responsible and proactive step, yet it can feel daunting. Knowing what to say is crucia...

Read More

Are you managing your debt? Or is it managing you? If you're stuck in a money quicksand trap, you may not even realize at first that you're in a finan...

Read MoreIt replaces anxiety with a sense of control. By having a plan you designed around your happiness, you eliminate the guilt of spending and the fear of wondering if you can afford your life. You know your priorities are funded, which brings immense peace of mind.

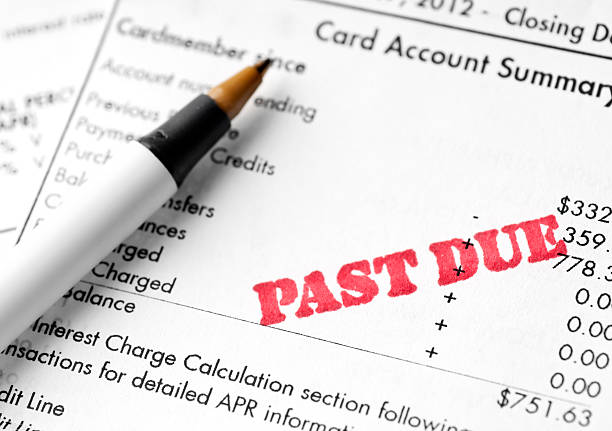

Accounting for 35% of your score, it is the strongest predictor of risk. Lenders want to see a consistent, on-time track record. Just one missed payment can cause a significant drop in your score, as it signals potential unreliability.

A new credit card increases your total available credit. If your balances remain the same, this instantly lowers your overall credit utilization ratio, which is a key factor in your credit score. However, this only works if you avoid using the new card for purchases.

Do not acquire new debt solely to improve your credit mix. The risks of deepening your financial crisis massively outweigh the potential, minor benefits. Manage the debt you have excellently, and your credit mix will improve naturally as your overall financial health recovers.

Yes. If you default on a debt, a creditor or debt buyer can file a lawsuit against you. If they win a judgment, they may be able to garnish your wages or levy your bank account to collect the owed amount.