The phenomenon of overextended personal debt is not merely a financial condition but a complex web of interconnected core concepts that trap individua...

Read More

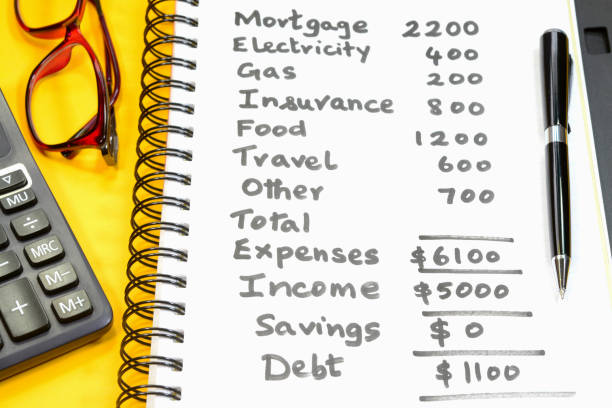

The personal budget, in its most ideal form, is a blueprint for financial freedom, a tool for aligning dreams with dollars. Yet, for an individual gra...

Read More

The journey into overextended personal debt often begins with a breakdown in personal budgeting, and the path out is almost invariably paved with its ...

Read More

Conscious spending is a transformative financial philosophy that moves beyond mere budgeting to cultivate a deliberate and values-aligned relationship...

Read More

In an age of curated perfection and instant gratification, financial stability is increasingly undermined by two subtle yet powerful forces: lifestyle...

Read More

In an era defined by readily available credit and complex financial products, the specter of debt overextension looms large for many. While numerous s...

Read MoreMany school systems do not require personal finance education, leaving young adults unprepared to manage credit, loans, and budgets when they enter the real world.

In some cases, yes. Providers may forgive debts through charity care, or debts may be discharged in bankruptcy. Some states also have programs to relieve medical debt for low-income residents.

Get a full financial picture. Gather all your statements and list every debt—credit cards, student loans, car loans, etc. For each, note the total balance, interest rate (APR), and minimum monthly payment. You can't make a plan until you know exactly what you're dealing with.

This strategy involves making minimum payments on all debts but putting any extra money toward the smallest debt balance first. The psychological win of paying off an entire debt quickly provides motivation to continue.

Federal law limits garnishment to the lesser of 25% of your disposable earnings (after taxes) or the amount by which your weekly income exceeds 30 times the federal minimum wage. Some debts, like child support or taxes, may allow higher limits.