Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and...

Read More

Entering one’s thirties often marks a pivotal decade of increased responsibility, career advancement, and growing financial complexity. For many, th...

Read More

The third decade of life is often portrayed as a period of consolidation: careers advance, families grow, and financial foundations solidify. Yet for ...

Read More

The trajectory of overextended personal debt is a story told in chapters, each defined by the unique pressures and perils of a different decade. It is...

Read More

The specter of overextended personal debt looms large in the modern economic landscape, a burden carried by millions. While often rationalized as a te...

Read More

The burden of student loan debt represents a uniquely formidable contributor to the crisis of overextension, particularly for individuals in their pri...

Read MoreBreaking the silence reduces shame and isolation. Confiding in a trusted friend, family member, or support group can provide emotional relief, practical advice, and a crucial reminder that you are not alone in your struggle.

Yes, from a financial responsibility standpoint, you should address it. While it won't remove the negative mark, updating the status to "Paid Charge-Off" looks significantly better to future lenders than an unpaid one and may help your score over time.

Assistance can include temporarily reduced interest rates, lowered minimum payments, waived late fees, a temporary pause on payments (forbearance), or a modified payment plan.

Consult a non-profit credit counselor for a annual financial check-up, even if you feel fine. They can help you optimize your budget, identify potential risks, and provide strategies to stay on track before any trouble begins.

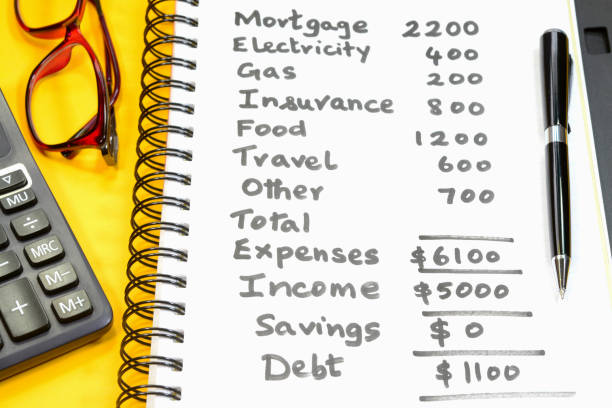

It typically divides your after-tax income into four main buckets: Fixed Costs (50-60%), Investments & Debt Repayment (10-20%), Savings Goals (5-10%), and Guilt-Free Spending (20-35%). This structure ensures your financial obligations and future are funded first.