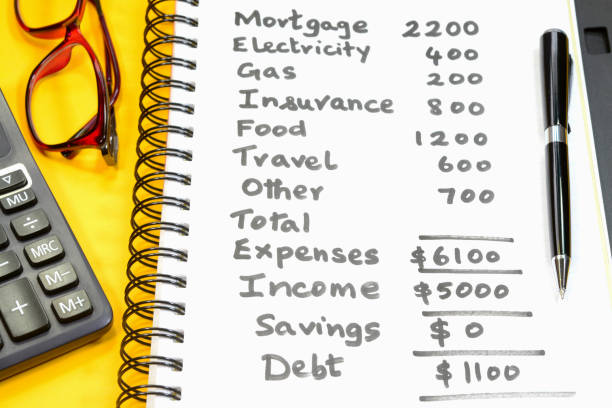

Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and prudent saving. Yet for a growing number, this decade becomes a crucible of anxiety, defined not by prosperity but by the suffocating weight of overextended personal debt. This financial strain transforms what should be a prime earning period into a precarious high-wire act, with profound implications for both present well-being and future security.The nature of debt in one’s forties carries a unique gravity. It is rarely the result of frivolous spending alone. Instead, it is frequently a perfect storm of life’s major expenses: a mortgage on a family home, auto loans for reliable transportation, and, most burdensomely, the cumulative cost of raising children, from childcare to education. Compounding this are often lingering student loans from one’s own youth and high-interest credit card debt accrued from navigating previous financial shortfalls. This debt load arrives precisely when financial responsibilities are at their maximum, creating a relentless pressure to maintain high earnings just to service monthly obligations.The psychological toll is immense. The constant calculation and juggling of payments erode mental peace, replacing the confidence of midlife with a pervasive sense of insecurity. Financial arguments can strain marriages, while the fear of an unexpected expense—a major car repair or a medical bill—becomes a source of constant low-grade dread. This debt-induced stress spills over, impacting health, focus at work, and the overall quality of life, turning the pursuit of the American dream into a exhausting race to stay afloat.Most critically, overextension in one’s forties steals from the future. Every dollar directed toward high-interest debt is a dollar not invested in retirement accounts, college funds, or other long-term wealth-building vehicles. The power of compound interest, a crucial ally for this age group, is lost. Consequently, the window for building a secure retirement narrows dramatically, forcing difficult choices between present necessities and a stable future. Ultimately, navigating this decade shackled by debt requires a sober reassessment of finances, often demanding disciplined budgeting, debt consolidation, and a recalibration of lifestyle to break the cycle and reclaim control before it is too late.

Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and prudent saving. Yet for a growing number, this decade becomes a crucible of anxiety, defined not by prosperity but by the suffocating weight of overextended personal debt. This financial strain transforms what should be a prime earning period into a precarious high-wire act, with profound implications for both present well-being and future security.The nature of debt in one’s forties carries a unique gravity. It is rarely the result of frivolous spending alone. Instead, it is frequently a perfect storm of life’s major expenses: a mortgage on a family home, auto loans for reliable transportation, and, most burdensomely, the cumulative cost of raising children, from childcare to education. Compounding this are often lingering student loans from one’s own youth and high-interest credit card debt accrued from navigating previous financial shortfalls. This debt load arrives precisely when financial responsibilities are at their maximum, creating a relentless pressure to maintain high earnings just to service monthly obligations.The psychological toll is immense. The constant calculation and juggling of payments erode mental peace, replacing the confidence of midlife with a pervasive sense of insecurity. Financial arguments can strain marriages, while the fear of an unexpected expense—a major car repair or a medical bill—becomes a source of constant low-grade dread. This debt-induced stress spills over, impacting health, focus at work, and the overall quality of life, turning the pursuit of the American dream into a exhausting race to stay afloat.Most critically, overextension in one’s forties steals from the future. Every dollar directed toward high-interest debt is a dollar not invested in retirement accounts, college funds, or other long-term wealth-building vehicles. The power of compound interest, a crucial ally for this age group, is lost. Consequently, the window for building a secure retirement narrows dramatically, forcing difficult choices between present necessities and a stable future. Ultimately, navigating this decade shackled by debt requires a sober reassessment of finances, often demanding disciplined budgeting, debt consolidation, and a recalibration of lifestyle to break the cycle and reclaim control before it is too late.

An emergency fund is cash set aside for unexpected expenses. It acts as a financial shock absorber, preventing you from needing to rely on high-interest credit cards or loans when unforeseen costs arise, which is a primary driver of debt.

Credit card statements are designed to make the minimum payment the easiest, most prominent option. This nudge exploits our inertia, encouraging a small payment that maximizes interest revenue for the lender while keeping the debtor in a long-term cycle.

Only if the interest rate is lower than what the utility charges in late fees or penalties. Explore assistance programs first to avoid exchanging one debt for another.

Yes. The definition of overextension is not just about defaulting; it's about a lack of financial resilience. If an unexpected $500 expense would force you to miss a payment or take on more debt, you are likely overextended and living paycheck-to-paycheck.

Massive student loan payments consume a large portion of a graduate's income for decades, limiting their ability to save for emergencies, qualify for a mortgage, or save for retirement, making them more likely to use credit for other life expenses.