The pursuit of a stable, prosperous life often hinges on two seemingly fundamental pillars: managing personal finances and raising a family. Yet, for ...

Read More

The financial burden of childcare is a significant concern for many families, often ranking as one of their largest monthly expenses. Amidst managing ...

Read More

Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and...

Read More

In an increasingly complex world, assistance programs serve as vital lifelines, offering a diverse array of support designed to foster stability, oppo...

Read More

In the complex landscape of modern life, many individuals and families encounter periods of financial strain, health challenges, or other hardships. T...

Read More

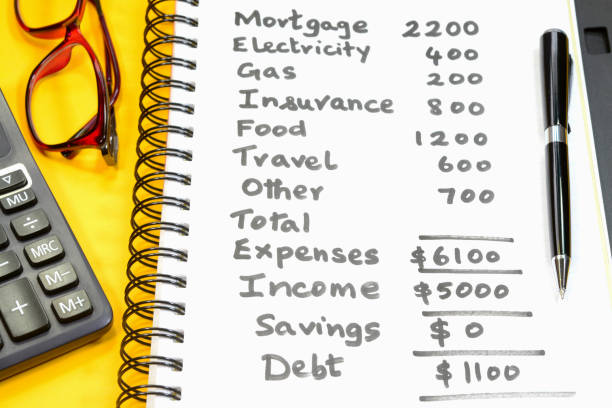

Are you managing your debt? Or is it managing you? If you're stuck in a money quicksand trap, you may not even realize at first that you're in a finan...

Read MoreAn emergency fund provides a cash buffer to cover essential expenses during a period of reduced income, reducing the need to rely on high-interest debt and helping to avoid missed payments that damage credit.

Yes, providers often negotiate lower amounts or offer settlements, especially if you can pay a lump sum. Always ask for an itemized bill and dispute any inaccurate charges.

Yes. They require your vehicle title as collateral, charge triple-digit interest rates, and risk repossession if you miss a single payment.

Your 40s are a critical wealth-building decade. Debt, especially high-interest consumer debt, directly sabotages your ability to save for retirement. The compound interest you should be earning on investments is instead being paid to creditors, significantly jeopardizing your long-term financial security.

Do both simultaneously if possible. Contribute enough to your employer's 401(k) to get the full match (it's free money), then aggressively tackle high-interest debt. For low-interest federal student loans, a balanced approach is often better than sacrificing retirement savings.