The weight of unmanageable debt can feel isolating and overwhelming, a labyrinth of monthly statements, high interest rates, and constant financial stress. For many individuals navigating this challenging terrain, credit counseling emerges not as a quick fix, but as a structured and educational lifeline. It assists with debt management by providing a holistic framework that combines expert financial assessment, personalized planning, creditor negotiation, and foundational education, ultimately empowering individuals to regain control of their financial lives.The process begins with a comprehensive financial review, a crucial first step that distinguishes credit counseling from generic advice. A certified counselor conducts a confidential, in-depth analysis of an individual’s entire financial picture. This includes examining all outstanding debts, from credit cards and medical bills to personal loans, alongside a detailed look at income, expenses, and assets. This diagnostic phase is essential, as it moves beyond the symptoms of debt to identify the underlying causes, whether they stem from a loss of income, overspending, unexpected emergencies, or a simple lack of financial literacy. This objective assessment provides a clear and often sobering reality check, establishing a factual baseline from which a realistic plan can be built.Following this review, credit counselors translate analysis into action through the creation of a personalized debt management plan, or DMP. This is the core operational tool for many clients. The counselor, acting as an intermediary, negotiates directly with creditors on the client’s behalf. These negotiations often secure concessions that are difficult for individuals to obtain alone, such as reduced interest rates, the waiving of certain fees, and the establishment of a single, affordable monthly payment. The counselor consolidates these negotiated terms into a single plan, simplifying the debtor’s obligations from multiple, daunting payments to one predictable monthly disbursement made to the counseling agency, which then distributes funds to creditors. This structured system eliminates guesswork, prevents missed payments, and creates a clear timeline for becoming debt-free, often shortening the repayment period significantly.Beyond the mechanics of repayment, however, lies the most transformative aspect of credit counseling: financial education. Reputable agencies are committed to addressing the root behaviors that lead to debt. Clients typically receive education on budgeting, smart spending, understanding credit reports and scores, and planning for future savings. This educational component is designed to instill lasting money management skills, ensuring that once the debt from the management plan is cleared, individuals are equipped to avoid falling back into similar patterns. This shift from crisis management to proactive financial wellness is perhaps the greatest long-term benefit, fostering confidence and self-sufficiency.It is important to recognize what credit counseling is not. It is not debt settlement, which seeks to reduce the principal amount owed, often with severe credit consequences. Nor is it a loan. Instead, it is a disciplined program for repaying debts in full under improved terms. While enrollment in a DMP may be noted on a credit report, the consistent, on-time payments made through the plan can help rebuild a damaged credit history over time, as they demonstrate responsible financial behavior to future lenders.In essence, credit counseling assists with debt management by serving as both a guide and an advocate. It demystifies complex financial situations, creates order from chaos through structured plans, and leverages professional expertise to secure better repayment terms. Most significantly, it couples this tactical support with the strategic gift of financial education. By offering a combination of immediate relief and long-term skill-building, credit counseling does more than just manage debt; it provides a sustainable pathway out of debt and toward a more secure and informed financial future, turning a moment of crisis into an opportunity for lasting change.

The weight of unmanageable debt can feel isolating and overwhelming, a labyrinth of monthly statements, high interest rates, and constant financial stress. For many individuals navigating this challenging terrain, credit counseling emerges not as a quick fix, but as a structured and educational lifeline. It assists with debt management by providing a holistic framework that combines expert financial assessment, personalized planning, creditor negotiation, and foundational education, ultimately empowering individuals to regain control of their financial lives.The process begins with a comprehensive financial review, a crucial first step that distinguishes credit counseling from generic advice. A certified counselor conducts a confidential, in-depth analysis of an individual’s entire financial picture. This includes examining all outstanding debts, from credit cards and medical bills to personal loans, alongside a detailed look at income, expenses, and assets. This diagnostic phase is essential, as it moves beyond the symptoms of debt to identify the underlying causes, whether they stem from a loss of income, overspending, unexpected emergencies, or a simple lack of financial literacy. This objective assessment provides a clear and often sobering reality check, establishing a factual baseline from which a realistic plan can be built.Following this review, credit counselors translate analysis into action through the creation of a personalized debt management plan, or DMP. This is the core operational tool for many clients. The counselor, acting as an intermediary, negotiates directly with creditors on the client’s behalf. These negotiations often secure concessions that are difficult for individuals to obtain alone, such as reduced interest rates, the waiving of certain fees, and the establishment of a single, affordable monthly payment. The counselor consolidates these negotiated terms into a single plan, simplifying the debtor’s obligations from multiple, daunting payments to one predictable monthly disbursement made to the counseling agency, which then distributes funds to creditors. This structured system eliminates guesswork, prevents missed payments, and creates a clear timeline for becoming debt-free, often shortening the repayment period significantly.Beyond the mechanics of repayment, however, lies the most transformative aspect of credit counseling: financial education. Reputable agencies are committed to addressing the root behaviors that lead to debt. Clients typically receive education on budgeting, smart spending, understanding credit reports and scores, and planning for future savings. This educational component is designed to instill lasting money management skills, ensuring that once the debt from the management plan is cleared, individuals are equipped to avoid falling back into similar patterns. This shift from crisis management to proactive financial wellness is perhaps the greatest long-term benefit, fostering confidence and self-sufficiency.It is important to recognize what credit counseling is not. It is not debt settlement, which seeks to reduce the principal amount owed, often with severe credit consequences. Nor is it a loan. Instead, it is a disciplined program for repaying debts in full under improved terms. While enrollment in a DMP may be noted on a credit report, the consistent, on-time payments made through the plan can help rebuild a damaged credit history over time, as they demonstrate responsible financial behavior to future lenders.In essence, credit counseling assists with debt management by serving as both a guide and an advocate. It demystifies complex financial situations, creates order from chaos through structured plans, and leverages professional expertise to secure better repayment terms. Most significantly, it couples this tactical support with the strategic gift of financial education. By offering a combination of immediate relief and long-term skill-building, credit counseling does more than just manage debt; it provides a sustainable pathway out of debt and toward a more secure and informed financial future, turning a moment of crisis into an opportunity for lasting change.

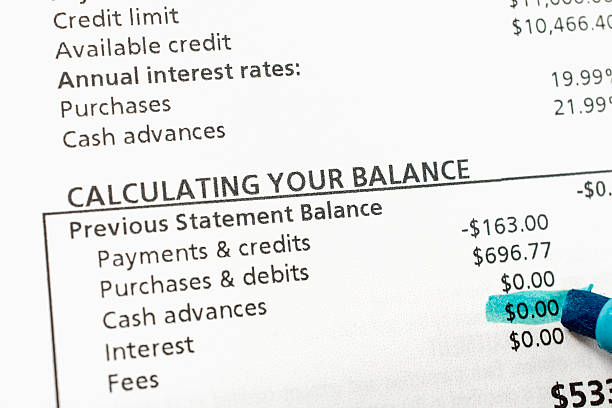

Many believe that making only minimum payments is sufficient, not realizing how long it takes to pay off debt this way or how much interest accumulates. Others see credit as "free money" rather than a future obligation.

Contact the provider immediately to explain your situation. Many offer payment plans, extensions, or hardship programs to avoid shut-offs or collections.

This rule suggests allocating 50% of income to needs, 30% to wants, and 20% to savings/debt. For those with high debt, the 20% toward debt may need to increase significantly, often requiring the "wants" category to be drastically reduced.

Credit card statements are designed to make the minimum payment the easiest, most prominent option. This nudge exploits our inertia, encouraging a small payment that maximizes interest revenue for the lender while keeping the debtor in a long-term cycle.

It dramatically increases your fixed expenses. A retirement income that would otherwise be comfortable is stretched thin by mandatory debt payments, forcing you to withdraw more from savings prematurely and drastically increasing the risk of outliving your money.