The phenomenon of overextended personal debt is not merely a financial condition but a complex web of interconnected core concepts that trap individua...

Read More

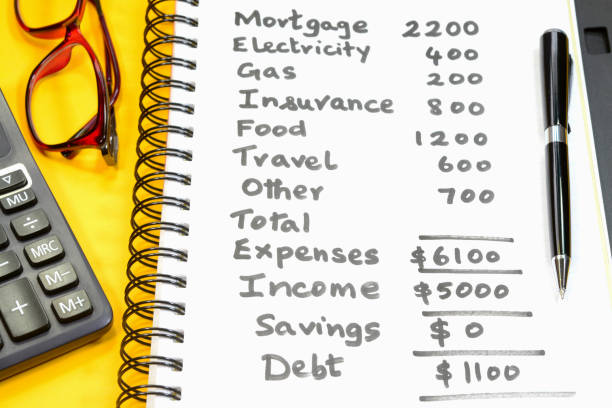

The personal budget, in its most ideal form, is a blueprint for financial freedom, a tool for aligning dreams with dollars. Yet, for an individual gra...

Read More

The journey into overextended personal debt often begins with a breakdown in personal budgeting, and the path out is almost invariably paved with its ...

Read More

Conscious spending is a transformative financial philosophy that moves beyond mere budgeting to cultivate a deliberate and values-aligned relationship...

Read More

In an age of curated perfection and instant gratification, financial stability is increasingly undermined by two subtle yet powerful forces: lifestyle...

Read More

In an era defined by readily available credit and complex financial products, the specter of debt overextension looms large for many. While numerous s...

Read MoreThis is when you return the car to the lender because you can no longer make payments. It severely damages your credit score and does not relieve you of the debt; you will still owe the difference between the loan balance and what the car sells for at auction.

Yes, but they are typically low and regulated. Agencies may charge a small setup fee (often waived for hardship) and a monthly maintenance fee, usually around $25-$50. These fees must be disclosed upfront.

Chapter 7 bankruptcy liquidates your non-exempt assets to pay creditors and can discharge most unsecured debts. Chapter 13 creates a court-ordered 3- to 5-year repayment plan based on your income. Both have severe, long-term consequences for your credit.

The only officially authorized website for free weekly credit reports under federal law is AnnualCreditReport.com. This is the safest and most reliable source to avoid scams or unwanted paid subscriptions.

The first session is a free financial review. A certified counselor will review your income, expenses, debts, and assets to provide a full assessment of your situation and discuss all available options, not just a DMP.