The journey of overextended personal debt often follows a predictable and harrowing path, beginning with missed payments and culminating in the most s...

Read More

Wage garnishment is a legal procedure where a portion of your earnings is withheld by your employer to pay a debt. It is often a last resort for credi...

Read More

The unsettling prospect of a creditor taking money directly from your paycheck is a significant concern for anyone facing debt. The direct answer to w...

Read More

The precarious state of overextended personal debt is often a private struggle until it triggers a series of formal and increasingly severe creditor a...

Read More

The third decade of life is often portrayed as a period of consolidation: careers advance, families grow, and financial foundations solidify. Yet for ...

Read More

The journey into overextended personal debt often follows a predictable path of struggle and anxiety, but its final destination—the charge-off—mar...

Read MoreFor known future costs like holiday gifts, car insurance premiums, or vacations, use a "sinking fund." This involves setting aside a small amount of money each month in a dedicated savings account so the expense can be paid in full with cash.

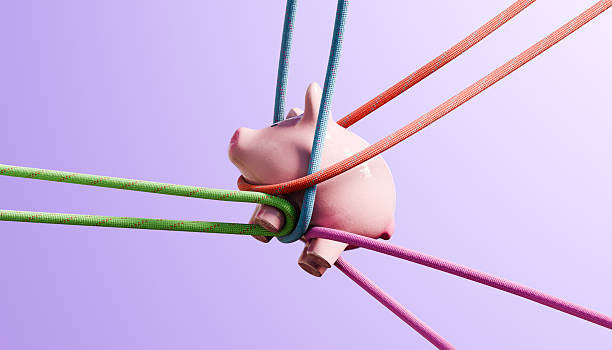

The biggest risk is extreme financial fragility. Any unforeseen event—a job loss, medical emergency, or car repair—can instantly trigger a downward spiral of missed payments, damaged credit, collection calls, and potentially bankruptcy.

Healthy spending aligns with your budget and values, while conspicuous consumption is driven by external validation and often involves neglecting financial responsibilities to fund a facade.

Contact the provider immediately to explain your situation. Many offer payment plans, extensions, or hardship programs to avoid shut-offs or collections.

The sooner you address it, the more options you have. Debt compounds negatively over time, just like investments compound positively. Tackling it early provides flexibility and prevents a full-blown crisis later in life.